A chief financial officer (CFO), more than any other C-suite member, holds the company’s future in their hands. Financial reporting has far-reaching legal implications and impact on financial markets. The stakes are even higher for privately held companies and family businesses: a family’s legacy is at stake. Refer to this ultimate guide to hiring the ideal CFO when hiring your first CFO or replacing your incumbent.

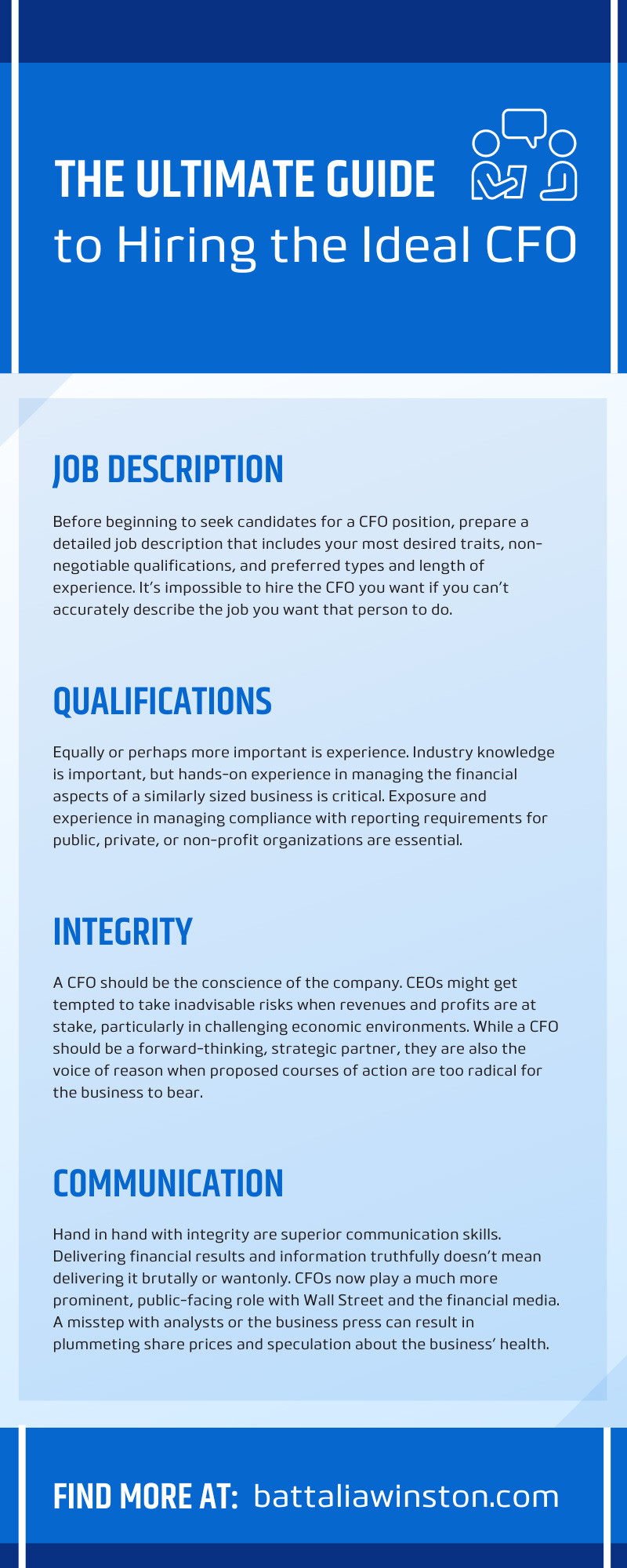

Job Description

Before beginning to seek candidates for a CFO position, prepare a detailed job description that includes your most desired traits, non-negotiable qualifications, and preferred types and length of experience. It’s impossible to hire the CFO you want if you can’t accurately describe the job you want that person to do.

If your company is in a position to hire a new CFO, it is also in a position to transform the role. This is especially true when a departing incumbent has held the job for a long time. While everything may be working well, the business may be missing opportunities for new forms of financing, cost savings, or restructuring relationships with suppliers that could benefit the bottom line.

Think strategically about what you’d like a new CFO to tackle and include that in the job description. But be realistic: include a reasonable timeline for when you expect the new hire to accomplish specific goals and start with the most achievable ones. Then move on to more long-term aspirations.

Qualifications

It goes without saying that a CFO should have an advanced degree in business, accounting, finance, economics, or a related field. Top candidates may also have professional certifications such as CPA, CFA, CMA, or another certification from a financial executives’ professional association.

Equally or perhaps more important is experience. Industry knowledge is important, but hands-on experience in managing the financial aspects of a similarly sized business is critical. Exposure and experience in managing compliance with reporting requirements for public, private, or non-profit organizations are essential.

CFOs oversee risk management, investments, debt, accounting and cash flow, assets and liabilities, financial reporting, taxation, and financial forecasting, which may affect major decisions like product development, mergers and acquisitions, and investments in new capital assets.

Education, experience, and certifications are top considerations for hiring the ideal CFO. Equally important are personal traits, often referred to as “soft skills,” that can spell success or failure for a new CFO hire.

Integrity

A CFO should be the conscience of the company. CEOs might get tempted to take inadvisable risks when revenues and profits are at stake, particularly in challenging economic environments. While a CFO should be a forward-thinking, strategic partner, they are also the voice of reason when proposed courses of action are too radical for the business to bear.

Any candidate for a CFO position must have an unblemished record of integrity and a reputation for delivering unbiased financial information truthfully, without “spin” designed to assuage the ego of the CEO or the egos on the board.

Communication

Hand in hand with integrity are superior communication skills. Delivering financial results and information truthfully doesn’t mean delivering it brutally or wantonly. CFOs now play a much more prominent, public-facing role with Wall Street and the financial media. A misstep with analysts or the business press can result in plummeting share prices and speculation about the businesses’ health.

CFOs must deliver accurate information within SEC rules for public companies and quash rumors about “succession” or upcoming changes in family-owned or privately held businesses. They also communicate with banks and investors.

Officers learn media skills through experience, and a new CFO must be able to remain calm, refuse to answer leading questions, or get baited into revealing more than the required information.

CFOs are also critical resources for board decisions and for legal teams, who must have accurate financial information to effectively represent the company in mergers, acquisitions, hostile takeovers, or legal disputes. The selected candidate must have a record of inspiring confidence and respect among the entire team of leaders upon whom the company relies.

Management

CFOs may lead teams of accountants, bookkeepers, and financial analysts and must keep an eye on payroll and human resources, including employee expenses and benefits. Setting a tone of approachability, accountability, and integrity across the company’s entire financial operation is a CFO’s responsibility.

Analytical and Strategic Thinking

Gathering data is one thing, but making sense of it and seeing possibilities in it, is quite another. A CFO should be able to articulate areas for improvement, expansion, or cost reduction based on company data and forecasts. They’ll be able to develop new financing sources and have a network of industry connections that may prove fruitful for strategic partnerships.

Technical Skills and Adaptability

Technical advances affect every industry and every leadership role within a business. A CFO must be open and eager to learn about technical improvements that can save the business money, streamline its operations, or expand its global reach.

When a CFO identifies a technical advancement that can benefit the company, they may get tasked with selling the adoption of new technology across company operations and between functional teams. This is another area where communication and management skills are critical.

Crisis Management

CFOs are on the spot when something happens that threatens the company’s revenue or even its very existence. They must know how to prepare and implement disaster plans that will preserve data and maintain operations in the face of unexpected disruptions.

The global pandemic that began in 2020 perfectly illustrates the impact of unanticipated developments on business. Every aspect of business got impacted, from the collapse of “just in time” supply chains to the nearly immediate shift to remote work. That means that costs, revenues, human resource management, and information security with a remote workforce became critically important and immediate concerns.

CFOs were on the line to help lead the pivot to new ways of operating that could help a business survive through lockdowns and massive changes in the workforce.

The competition for qualified CFOs in the changed business environment of the twenty-first century makes it imperative that businesses consider hiring professional financial executive recruiters. Search professionals will help companies to avoid common mistakes in a CFO search. They will work with search committees to limit false starts and quickly develop a pool of highly qualified candidates from which to choose.